Date of publication: 16 October 2024

Yevgen Solovyov, Attorney at Law, Partner

Source: Yurydychna Gazeta

On 3 September 2024, significant and long-awaited amendments were introduced to the legislation governing the state registration of separate subdivisions of foreign legal entities in Ukraine (hereafter also “Separate subdivisions”). These changes came in response to Law No. 3257-IX, enacted on 14 July 2023.

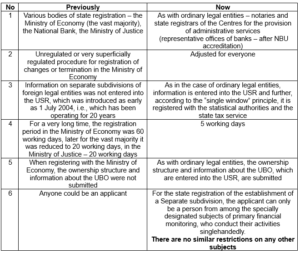

These updates were much needed, as the registration process for various Separate subdivisions had previously been inconsistently regulated, often inadequately addressed, outdated, and misaligned with current realities. The primary changes are summarized in the table below:

- Change of registration subjects. I am confident that for lawyers with experience navigating registration procedures for Separate subdivisions – regardless of which ministry oversaw their registration or whether it occurred recently or decades ago – this change will be universally welcomed. Among all recent reforms, this one may be the most fundamental, significant, and eagerly anticipated. In fact, even if no other improvements were made, this single development would still represent a “major victory”. This change is expected to drastically reduce the number of situations where lawyers must explain to foreign clients the complexities of Ukrainian registration. These complexities can often be perplexing, even for seasoned professionals with a deep understanding of local nuances.

- Irregularity of procedures. Most representative offices were traditionally registered by the Ministry of Economy based on a directive issued in January 1996. This directive outlined a 16-point process. This directive underwent only one amendment in 2007, meaning that even the procedures it specified for initial state registration of representative offices failed to reflect current realities. Furthermore, there were no guidelines for processes such as updating registration details or closing offices. Consequently, unclear regulations often resulted in inconsistencies. Ministry of Economy employees could, at their discretion, request various documents for specific procedures. The requirements and timelines often shifting based on the employee, their approach, or other factors. Practitioners familiar with these procedures can truly appreciate the impact of such inconsistencies. For instance, obtaining a re-registration certificate or initiating the liquidation of a representative office required outdated steps, such as publishing a mandatory announcement in specific newspapers like Holos Ukrayiny or Uriadovyi Kurier though the revised framework may still reveal areas for improvement upon close examination and practical use, even in its current form, it represents a significant step forward.

- Entering information into the USR. Previously, Ukrainian legislation did not require information about representative offices registered with the Ministry of Economy to be included in the USR (the Unified State Register of Legal Entities, Individual Entrepreneurs, and Public Organizations). In contrast, for many years, information about separate units of foreign non-governmental organizations and charitable foundations registered by the Ministry of Justice has been mandated by law to be entered into the USR, rather than through subordinate regulatory acts. However, as is unfortunately often the case in Ukraine, this legal requirement was not implemented in practice. As a result, information about these separate subdivisions was recorded only in the USREOU (Unified State Register of Enterprises and Organizations of Ukraine) by statistical authorities. This situation complicated the registration process, as the “single window” principle did not apply to separate subdivisions of foreign legal entities, necessitating additional visits to statistical and tax authorities. It also affected operations transparency and access to information about these subdivisions. Since they were not listed in the publicly accessible USR, databases like YouControl, which operate using their own algorithms, contained information on only a portion of these subdivisions. Even then, the available details were very limited. This issue is likely one of the reasons behind the upcoming changes to the USR name.

As of 13 September 2024, notaries or state registrars at Centres for administrative services will, by default, be unable to perform registration actions for existing Separate subdivisions (such as making changes), since information about these entities is not available in the USR.

In a statement posted on its website on 3 September 2024, the Ministry of Justice indicated that the process of transferring Separate subdivisions data to the USR will take an unspecified “period of time”, with no set deadline. In practice, this process could take years. This is particularly given that for many years, information about the separate units of foreign non-governmental organizations and charitable foundations has not been entered into the USR, despite the legal requirement to do so. Introducing the USR software to facilitate this data transfer was necessary, but not accomplished.

Resolution No. 1004 of the Cabinet of Ministers of Ukraine dated 3 September 2024 stipulates that until the USR software is finalized, the transfer of information about Separate subdivisions to it will be carried out exclusively based on applications submitted by their representatives. At the same time, the following is unclear: if there is a technical possibility to transfer information about the Separate subdivisions to the USR upon the application of the representative of the Separate subdivision, why it is impossible to do this independently without such a statement? And what prevents the USR finalization by 09/03/2024 is unknown. It is also unclear how long it will take and when it will happen. I would like to be wrong, but given the fact that the USR software has not been brought into compliance with the legislation for registration of separate units of foreign non-governmental organizations and charitable foundations in the USR for many years – probably not soon.

The new registration application form 11 introduced by the Ministry of Justice provides for such registration action as the transfer of information about a separate subdivision. According to the message above, in order to be able to, for example, register changes, first you need to contact the Ministry of Justice and submit form 11 to transfer information about a separate unit to the USR, and only then, when such information is transferred, go to a notary or Centre for the provision of administrative services and submit documents for the corresponding registration action. The deadline for transferring information upon a representative’s application is 3 working days. And if the need to make changes arises after 3 years, it is quite possible that all this time your Separate subdivisions may not be included in the USR.

- Registration terms. Reducing the registration period from 20 to 5 working days is a positive change. It has always been challenging to justify, not only to foreigners but even to ourselves, why registering a legal entity takes just 1 working day. In contrast, registering a separate unit requires 20 times longer, despite being no more complex. This issue is exacerbated by the fact that state bodies often interpret the phrase “within 20 working days” as “after 20 working days”. If you call 2-3 weeks after submitting your documents to check on the status, you’re likely to be met with surprise or even irritation. You may receive a response like, “The deadline hasn’t passed yet. Why are you calling so early?” However, it’s still unclear why the registration period wasn’t shortened to just 1 working day. Meeting that deadline for the registration of ordinary legal entities poses no significant challenge for notaries or for state registrars at Centres for the Provision of Administrative Services. These centres currently handle far fewer registration tasks than notaries. Nonetheless, 5 working days is a significant improvement over 20 – four times faster, in fact – so there’s progress to be thankful for and still room to improve.

- Presentation of the ownership structure and UBO information. Representative offices registered with the Ministry of Economy are unlikely to welcome this news. However, it makes sense given the long-standing similar requirements for ordinary legal entities and the separate units of foreign non-governmental organizations and charitable foundations. If presented with two options – either continue submitting documents to the Ministry of Economy, which may take a month to review them with an uncertain outcome but without requiring details on ownership structure and UBO, or opt for a notary who will process the documents in a few days with a much more predictable positive result but with the inclusion of ownership structure and UBO information – I believe most would choose the latter. For those who have no issues disclosing ownership structure or UBO, the second option is clearly more efficient.

- Change of applicant. Of course, no barrel of honey exists without a big spoonful of tar. The first issue to address is that no other entities face similar restrictions. Anyone can submit documents to establish Ukrainian companies, public organizations, or charitable foundations, even if foreign individuals or legal entities are involved, without complications. Yet, when it comes to creating a Separate subdivision, there is now an exception: only a specifically designated primary financial monitoring subject is deemed worthy of handling this process. Moreover, it must be an entity operating as a sole representative. Meanwhile, for making changes to or terminating a Separate subdivision, any representative can still submit the documents, just as before. The inconsistency is difficult to overlook.

The law identifies specific subjects of primary financial monitoring (excluding individuals who provide services under employment relationships). These include law firms, associations of lawyers, attorneys who practice law independently, business entities that offer legal services, and individuals who provide services related to the establishment, operation, or management of legal entities, trusts, and other entities without formal status.

It is important to emphasize that, in most cases, foreign legal entities seek legal services from Ukrainian law firms, particularly in matters such as establishing joint ventures. This is in place of individual lawyers or other practitioners who operate independently. Lawyers and attorneys in law firms typically provide services as part of an employment relationship.

The real question isn’t just why legislators decided that, from now on, only specifically designated subjects of primary financial monitoring can submit documents for the establishment of a private financial institution – although that is indeed a significant question. What’s even more puzzling is why this role is only available to independent entities.

To establish a consistent approach, the Ministry of Justice issued a directive in Letter No. 125957/8.4.3/32-24, dated 11 September 2024, clarifying how notaries and state registrars should verify the applicant’s status. According to the directive, if the applicant is an individual practicing law, verification should be done through the Unified Register of Advocates of Ukraine. For individual entrepreneurs whose primary activity is providing legal services, information should be confirmed via the USR. The letter specifies that notaries and state registrars will refuse to proceed if these criteria are not met:

a) To lawyer applicants who, according to the Unified Register of Advocates of Ukraine, do not practice law individually but are part of law offices or associations.

b) To other applicants, including designated subjects of primary financial monitoring who operate independently, if they are not individual entrepreneurs or, if they are, their main activity is not classified as legal services (presumably under KVED 69.10 – legal activities).

It is entirely unclear why a lawyer employed by a law association is treated differently from one practicing independently. It is also unclear why their rights have been restricted in this way. Moreover, it raises the question of why someone who is just registered as an individual entrepreneur with legal services as their main activity – even if they are not actually lawyers – is allowed to submit documents. In contrast, a lawyer working in a law association, who is not registered as an individual entrepreneur, is not permitted to do so.

Conclusions

It is important to recognize that, apart from the obvious inconveniences and limitations imposed on foreign legal entities and Ukrainian lawyers (representatives), the changes described in paragraph 6 have also introduced potential grounds for contesting the future state registration of the creation of separate subdivisions.

It remains unclear how or why these provisions, in their current form, entered the draft law. They passed through all legislative stages, and were ultimately enacted. However, I sincerely hope this issue will be addressed and corrected soon.

Overall, the changes are positive, and I am optimistic about further improvements. There is still much work to be done and additional responsibilities to notaries, so we can consider this a promising start to a worthwhile endeavour.