-

Overview of Key Shifts Impacting International Trade Practice in 2024

#International TradeArticle, Client’s Choice 2023: TOP-100 Lawyers of Ukraine

2 April 2024

-

2024 Maritime Law Trends & Estimates: What Lays Ahead for the Industry?

#Infrastructure #Transport & Logistics #Maritime LawArticle, Client’s Choice 2023: TOP-100 Lawyers of Ukraine

2 April 2024

-

Anticipated Trends and Forecasts in Medical Law for 2024

#Medicine & HealthcareArticle, Client’s Choice 2023: TOP-100 Lawyers of Ukraine

2 April 2024

-

Business Support? No Idea… Why are Ukrainian Manufacturers Left Defenseless Against the Imports?

#International TradeArticle, European Pravda

19 March 2024

-

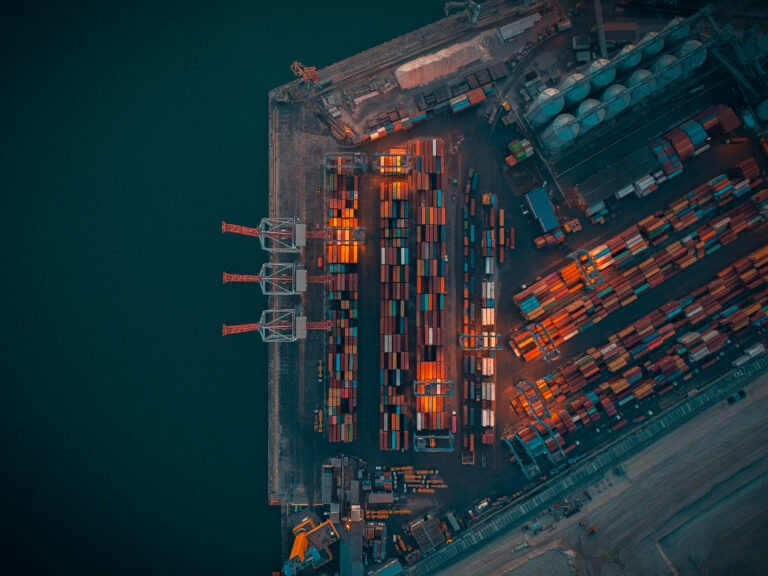

Black Sea and Danube Alternatives: Under What Conditions Do They Make Up for the Polish Border Blockade

#Shipping #Transport & Logistics #Maritime Law #International TradeArticle, European Pravda

7 March 2024

- Show more 243